What is a DCF Analysis & How Is It Done?

When it comes to evaluating the financial health and value of a company, Discounted Cash Flow (DCF) analysis is a fundamental tool used by analysts, investors, and financial professionals. In this comprehensive guide, we will explore the concept of DCF analysis, its formula, the step-by-step process for conducting it, its applications, real-world examples, and where to obtain the necessary data for accurate DCF analysis.

What is Discounted Cash Flow (DCF) Analysis?

Discounted Cash Flow (DCF) analysis is a financial modeling technique used to estimate the intrinsic value of an investment, typically a company, project, or asset. It is based on the principle that the value of an investment is determined by the present value of its expected future cash flows. In other words, DCF analysis helps you determine what a future stream of cash flows is worth in today's terms.

DCF analysis is widely used in various financial scenarios, such as valuing stocks, assessing the feasibility of capital projects, and evaluating the worth of an entire business.

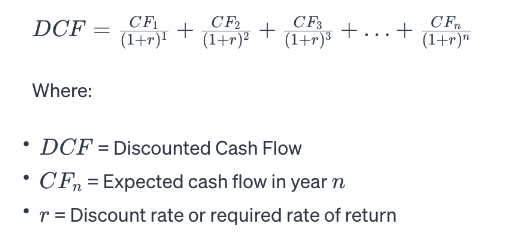

Formula for DCF Analysis

The formula for DCF analysis can be expressed as follows:

How to Do DCF Analysis

Step 1: Forecast Cash Flows

Start by forecasting the future cash flows of the investment or business you are analyzing. These cash flows can include revenue, operating expenses, capital expenditures, and taxes. It's important to create a detailed and realistic projection for each period.

Step 2: Determine the Discount Rate

The discount rate, often referred to as the required rate of return, represents the minimum rate of return an investor expects from the investment. It accounts for the time value of money and the associated risk. The discount rate can vary depending on the investment's risk profile.

Step 3: Calculate Present Value

For each projected cash flow, calculate its present value by dividing it by (1+r)ⁿ where n is the number of years into the future. Sum up all the present values to obtain the total present value of the cash flows.

Step 4: Estimate Terminal Value

Determine the terminal value, which represents the value of the investment at the end of the forecast period. This can be calculated using various methods, such as the perpetuity growth model or exit multiple method.

Step 5: Calculate DCF

Add the total present value of the cash flows from Step 3 to the terminal value from Step 4. The result is the estimated intrinsic value of the investment.

Step 6: Compare to Market Price

Compare the calculated DCF value to the current market price of the investment. If the DCF value is higher than the market price, the investment may be undervalued, indicating a potential buying opportunity. Conversely, if the DCF value is lower, it may be overvalued.

Uses of a DCF Analysis

DCF analysis serves various purposes in the world of finance and investment:

1. Stock Valuation:

- Investors use DCF analysis to estimate the fair value of a company's stock. By comparing the calculated intrinsic value to the market price, investors can make informed decisions about buying or selling stocks.

2. Capital Budgeting:

- DCF analysis helps businesses assess the feasibility of capital projects, such as building new facilities or launching new products. It helps in determining whether the expected cash flows justify the initial investment.

3. Mergers and Acquisitions (M&A):

- In M&A transactions, DCF analysis is used to evaluate the value of a target company. It helps acquirers determine whether a potential acquisition is financially sound and aligns with their strategic objectives.

4. Real Estate Investment:

- Real estate investors use DCF analysis to assess the value of income-generating properties. It takes into account rental income, operating expenses, and the property's resale value.

5. Business Valuation:

- DCF analysis is a key tool in determining the value of an entire business. It considers the expected cash flows generated by the business over time.

Examples of DCF Analysis

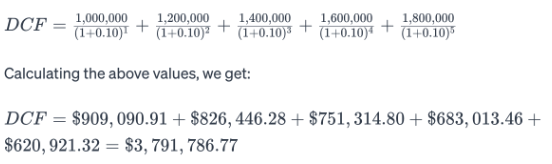

Let's consider a simplified example of DCF analysis for valuing a company's stock:

- Company XYZ is expected to generate the following annual cash flows for the next five years: $1 million, $1.2 million, $1.4 million, $1.6 million, and $1.8 million.

- The required rate of return for investors is 10%.

- To calculate the DCF value, we apply the formula for each year's cash flow and sum up the present values:

So, the estimated intrinsic value of Company XYZ based on DCF analysis is approximately $3.79 million.

Now, if the current market price of Company XYZ's stock is below $3.79 million, it may be considered undervalued, indicating a potential investment opportunity. Conversely, if the market price is higher, it may be overvalued, suggesting caution or potential selling.

Where to Get Data for DCF Analysis

Accurate and reliable data is essential for conducting DCF analysis effectively. Here are some sources where you can obtain the necessary data:

1. Financial Statements:

- Company financial statements, including income statements, balance sheets, and cash flow statements, provide essential data for forecasting future cash flows. These statements are typically available on the company's website or through financial databases. Note - most of this data isn’t standardized (comparable across time periods or companies), isn’t available via API, and isn’t supported or documented

2. Historical Stock Prices:

- Historical stock price data is crucial for estimating the required rate of return and assessing the volatility of the investment. You can access historical stock prices through financial news websites, stock exchanges, or financial data providers. Note - these sources are unlikly to offer APIs, support, documentation, or any sense of reliability.

3. Economic Data:

- Economic indicators, such as inflation rates, interest rates, and GDP growth, can impact cash flow projections and discount rates. Government websites and economic data providers offer access to relevant economic data.

4. Market Data Providers:

- Specialized market data providers like Intrinio offer comprehensive financial and market data. These providers offer a wide range of data feeds and tools designed to support financial analysis, including DCF analysis. Data is made available via API and is well documented and supported.

5. Industry Research:

- Industry-specific research reports and market analyses can provide valuable insights into industry trends, growth rates, and competitive dynamics. Research firms and industry associations often publish such reports.

In conclusion, Discounted Cash Flow (DCF) analysis is a powerful financial tool used for valuing investments, projects, and businesses. By projecting future cash flows and discounting them to their present value, DCF analysis helps investors and financial professionals make informed decisions about the attractiveness of an investment. Accurate and up-to-date data is crucial for conducting DCF analysis effectively, and various sources are available to obtain the necessary data. Understanding DCF analysis is a valuable skill for anyone involved in finance, investment, or business valuation.

.jpg)